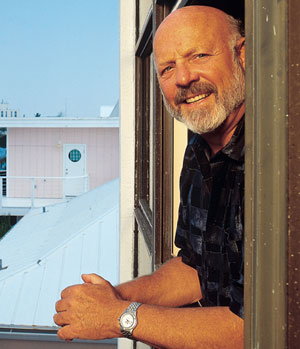

A pioneer in the development and trading of technical, computer-based models for futures portfolios, William A. "Bill" Dunn is a legend among futures traders for his analysis of market trends and a superstar in the world of free market philanthropy.

With a doctorate in theoretical physics and a professional career built on factual analysis, Bill's intellect is formidable. Yet within seconds of meeting him, he puts all concerns to rest. His famous grin warms any room he's in, and he immediately puts visitors at ease with his relaxed style and laid-back conversation. A fly fisherman, sailboat racer, Marine, business executive, world traveler, and philanthropist, Bill Dunn is the man who rides the bucking bronco and makes it all look easy.

Like so many others who share his classical liberal perspective, Bill's initial exposure to the ideas of freedom began with a chance encounter with the writings of Ayn Rand. During a summer hiatus in 1963, Bill came across The Virtue of Selfishness, Rand's short collection of essays on ethical philosophy. "It was dynamite," Bill recalled. "I had been reading National Review and Human Events, and suddenly things just coalesced for me." He continued his studies in theoretical physics at Northwestern University, even playing host to renowned economist Ludwig von Mises during a lecture stopover on campus. Bill remembers him as "gentlemanly," but able to easily dismiss hecklers and leftist opinions with the voice of authority.

1963 was a good time to be interested in liberty. The Goldwater campaign was just gearing up, and Bill's libertarian leanings meshed perfectly with the Goldwater refrain of low taxes and limited government. After completing a Ph.D. in theoretical physics at Northwestern University in 1966, Bill went to work for the Navy, Marine Corps, Coast Guard and the Joint Chiefs of Staff as a contractor in the cost-benefit analysis under former Secretary of Defense Robert MacNamara. MacNamara, a former Ford executive, knew that working with the private sector brought both accountability and efficiency to government projects, and employing outside consultants like Bill kept defense costs down.

In the early 1970s, Bill saw an opportunity to apply his mathematical skills to the world of finance, when he came across a newsletter referencing a futures trading system that caught his interest. His exhaustive research led him to develop a sustainable model that examines data to determine major market trends and incorporates a set of rules on how to trade a futures portfolio. His system attracted the nation's second largest commodities brokerage, and Bill never looked back after founding DUNN Capital Management in 1974.

"Trends are not predictable, but they're not random events," said Bill. "They are created by real changes in supply and demand that happen over the course of many months, and they can be analyzed and understood if you are willing to follow certain rules. Otherwise, the market can be brutal, and those who don't learn will disappear."

A longtime supporter and board member of free market policy organizations such as Reason Foundation, Cato Institute, Competitive Enterprise Institute, Institute for Justice, and the Property and Environment Research Center, Bill's thoughtful perspective has helped lay the intellectual groundwork necessary for a free society.

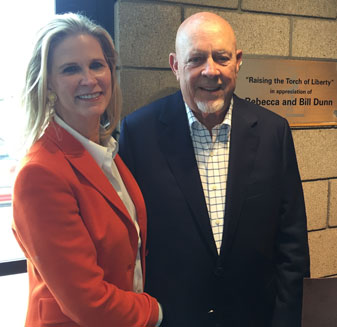

A real estate developer, interior designer and philanthropist in her own right, Rebecca Walter met Bill Dunn through a shared passion for individual liberty and free markets. They were married in 2002. Since then, they have worked tirelessly to ensure that all Americans are able to exercise the right to life, liberty, and the pursuit of happiness.

As a classical liberal, Bill has dedicated his life to advancing his core belief in the principles of individual liberty, free enterprise, and limited government. "The need to limit government growth has never been more urgent," said Bill. "Until the government abides by the Constitution, our liberty will be at the mercy of politicians and government officials who have proven themselves unable or unwilling to restrain themselves."

"Trends are not predictable, but they're not random events," said Bill. "They are created by real changes in supply and demand that happen over the course of many months, and they can be analyzed and understood if you are willing to follow certain rules. Otherwise, the market can be brutal, and those who don't learn will disappear."

A longtime supporter and board member of free market policy organizations such as Reason Foundation, Cato Institute, Competitive Enterprise Institute, Institute for Justice, and the Property and Environment Research Center, Bill's thoughtful perspective has helped lay the intellectual groundwork necessary for a free society.

A real estate developer, interior designer and philanthropist in her own right, Rebecca Walter met Bill Dunn through a shared passion for individual liberty and free markets. They were married in 2002. Since then, they have worked tirelessly to ensure that all Americans are able to exercise the right to life, liberty, and the pursuit of happiness.

As a classical liberal, Bill has dedicated his life to advancing his core belief in the principles of individual liberty, free enterprise, and limited government. "The need to limit government growth has never been more urgent," said Bill. "Until the government abides by the Constitution, our liberty will be at the mercy of politicians and government officials who have proven themselves unable or unwilling to restrain themselves."